(Edited by A. Sorensen and J. Okata Megacities, Urban Form, Governance, and Sustainability, Springer, Tokyo Dordrecht Heidelberg London New York, 2010)

The growth of Brazilian cities during the second half of the 20th century has been intense. Large cities, including the former capital Rio de Janeiro (Brasília has been the capital since 1960) experienced rapid population growth, along with an expansion of the urban area and the concentration of poverty in peripheral regions.

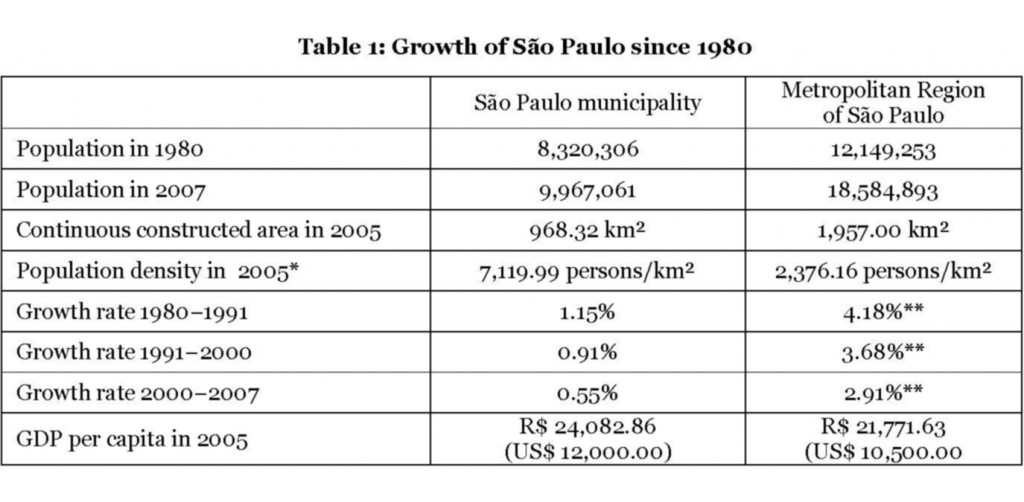

The case of São Paulo is particularly significant. In 1850 the city, capital of the state of the same name, was not one of the ten largest in the country. But by the beginning of the 20th century, São Paulo was the second-largest city in Brazil and in the 1950s, it surpassed Rio de Janeiro as the largest city in the country. São Paulo’s population growth, population density, continuous constructed area, and GDP per capita for 1980 and 2007 are shown in Table 1.

This intense growth of population and area was initially determined by the expansion of the coffee plantations in the state’s rural zones. As coffee was transported by railway to the Santos port (the largest port in Brazil), it necessarily passed through São Paulo. At the same time, immigrants from Europe and Japan who arrived in Santos and went inland to work in the coffee plantations passed also through São Paulo and many stayed there increasing the city population. After the crisis of the 1930s, import substitution resulted in intense industrial development in the city so that between 1930 and 1960, São Paulo became the largest industrial city in Latin America.

The city’s growth at the beginning of the 20th century was due mainly to international migration from European countries (Portugal, Spain, Italy, and Germany) and from Japan after 1908. But industrial growth from 1930 onwards attracted internal migrants, mainly from the northwest of the country and the rural areas of São Paulo state.

The demand for urban land and infrastructure caused by this flow of migrants was considerable. Formerly, housing, water, sewage facilities, roads, and transportation had been provided privately by individual fazendas (farms). With migration into the city, the pressure on government to provide those services for newcomers who settled in the peripheral areas of the city increased sharply.

Source: Miranda, E. E. de; Gomes, E. G. Guimarães, M. Mapeamento e estimativa da área urbanizada do Brasil com base em imagens orbitais e modelos estatísticos. Campinas: Embrapa Monitoramento por Satélite, 2005. Available at: <http://www.urbanizacao.cnpm.embrapa.br>.

* This density refers to the population in the continuous constructed area. Part of the population is scattered along the rural area of the municipality of São Paulo and the Metropolitan Region of São Paulo.

** Average population rate growth of the 49 municipalities belonging to the MRSP.

When new agricultural technologies were introduced in the 1960s, the substitution of crops (mainly coffee for soybeans) and the general mechanization of agriculture resulted in a sharp reduction of the labor force in the agricultural sector and a consequent increase in the urban population, especially in São Paulo. Workers who had lost their jobs had no other alternative than to migrate with their families to urban areas. In the cities, they settled into what was then considered the periphery, where land was cheap, and built shanties in areas where the reaction to this invasion was weaker – mainly in public areas at the edge of creeks or in conservation areas. The great majority of these new poor communities, or slums, had no infrastructure and the pressure for public investment increased considerably.

During the 1970s, the devaluation of the dollar after the abandonment of the Bretton Woods Agreement and the economic crisis that followed the rise in commodity prices, especially oil, affected the Brazilian economy strongly. Both external and public debt increased sharply. Inflation soared as devaluation was used to stimulate exports in order to pay interest on the external debt. The government’s investment capacity dwindled to almost nothing. São Paulo was one of the cities most affected by this process.

At this point, there was no capacity to maintain existing or build new infrastructure or provide services (such as transportation, water, sewage, or waste disposal). Nevertheless, the demands of the poor in the slums on the periphery of the city − and in some cases in the new areas where the middle and upper middle classes were living − could no longer be ignored. The end of Brazil’s military dictatorship and the return to democratic institutions (such as free elections) meant that the new political parties had to try to attract votes.

No longer was it possible simply to demolish slums. The demands of the poor had to be considered, even if only in the pre-electoral period. New methods were needed to deal with the so-called “social question” and the city’s management. The authorities not only had to address the presence of slums in the periphery, but also increasing traffic congestion in the central areas of the city where the upper classes lived.

Urban sprawl, resulting from high land prices in the central zones and the expansion of the city’s peripheral areas, increased infrastructure costs (transportation, for instance) and led to negative and perverse consequences. The high costs of services such as transportation, lighting, sewage, waste disposal, or paving meant that poor families either received very low-quality services or no services at all.

This urban development process was not sustainable either from the economic, or from the social and environmental perspective. Economic sustainability required an investment capacity and expenditure on new services that the municipality could not afford. Social sustainability depended, among other factors, on the reversal of the segregation process (gentrification) caused by high prices for the best-located land, caused by the urban intensification process itself. And environmental sustainability was menaced by the occupation of conservation areas by lower- and middle-class housing, water contamination in the city’s rivers by residential and industrial sewage disposal without treatment, and air pollution caused by industry and automobiles, particularly old buses and trucks.

The solution to or mitigation of these problems required new planning instruments, including new urban legislation, new institutions, new forms of city management, new ways to finance urban development, new relations between the private and the public sector, and a new approach to the problem of the slums. As we will see, not all of the needed instruments were created, and even where new planning instruments were put in place, in some cases the outcome was not what was intended.

New Urban Legislation: The Embú Letter

The need for a new approach to urban development emerged in the 1970s with the chaotic, unsustainable growth of cities, especially the two largest in Brazil: Rio de Janeiro and São Paulo. Architects, sociologists, jurists, urban specialists, and public servants began to propose and discuss new intervention instruments in urban development.

An important result of these discussions was the “Embú Letter,” the product of a meeting in 1976 in Embú, in the state of São Paulo. One of the most important concepts of this document was the concept of solo criado, which means the opportunity to increase the floor area ratio (FAR) of a building plot or give owners or developers greater latitude in construction than they had had before. This was a consequence of the separation of the right of property and the right to build provided in the legislation. The opportunity to construct larger buildings could be granted if the public administration presented a proposal to the Council to change the zoning law.

Under the previously existing legislation, every landowner could construct a building for which the FAR could range from 1 to 4 times the plots area, and in some special cases 6 or even 12 times). . But for the great majority of areas, the permitted FAR was 1 or 2. The new approach meant that plots that had a FAR of 1 or 2, if the builder met certain conditions ( specially infrastructure limitations), could be increased to 3 or 4.

Another important contribution of the Embú Letter was the stipulation that the benefits of any increase in FAR (or a change in use) granted by the public sector to private owners should be shared. The principle on which this requirement was based was the sense that if the public sector grants more construction rights to the owner, it is in effect “creating” land, and this new value created should be divided between them.

The Onerous Grant (Outorga Onerosa) Mechanism

Generally, all changes in zoning granting more rights to construct or changing the potential uses for plots increased the value of the land. This increased value had formerly benefited only the owner of the land. With the new approach under the Embú Letter, the question arose: how much of this added value should be appropriated by the public sector and how much by the private owner of the land? And, more important, in practical terms, how should this instrument operate?

With the end of the military dictatorship in the first half of 1980 and the reintroduction of elections, the old methods of slum demolition and expulsion of the families who formed slums on private land were not possible any more. So the first and concrete example of value increment appropriation by the public sector through the onerous grant mechanism (outorga onerosa) happened under the Operações Interligadas (Interlinked Operations) law, issued in the city of São Paulo in 1987.

The main goal of this new legislation (which was not inspired by the Embú Letter) was to solve the problem of well-located private land occupied by slums. A private landowner whose plots were occupied by slums could propose an increase in FAR or change the uses of the land and share the increased value with the public sector. The public sector received a minimum of 50% of this increased value. The benefits received by the public sector was destined exclusively to build social housing (at first, this was to be done by the landowner; later it was built by the government with money paid by the landowner) in other areas of the city for the families that would be displaced.

Many operations of this kind were approved, but with a very important change: the provision operated even in cases where the land was not occupied by slums. The majority of Interlinked Operations after 1988 were on land that did not contain slums. But part of the value appropriated by the public sector had to be used in the construction of houses for families removed from slums located in other places of the city, mainly areas subject to floods and landslides.

These operations lasted until 1998, at which point they were declared unconstitutional because although there was a law permitting them, they contradicted the existent zoning law and regulations, and changes in these laws were attributes of the Legislative and not of the Executive . However, during almost 12 years (from 1987 until 1998), about 115 projects of this kind were approved and the value appropriated by the public sector (around $100 million U.S.) financed the construction of more than 11,000 houses for families that had formerly lived in slums.

For a city like São Paulo, this was not a large amount of money or expressive number of social houses constructed. Nor did these operations represent better city planning; on the contrary, they were thought to interfere with the Master Plan (even if the existent Master Plan was obsolete and a new one had not yet been approved), because they were ad hoc, led to distortions in the zoning law, and created privileges for landowners and developers (even if they had to pay for the benefits received).

But this practice established the principle of appropriation by the public sector of part of the increased value of a property (because this increment was due to actions or new norms provided by the public sector) and negotiating this participation with the private sector. Until 1986 the private sector had appropriated (with few exceptions) all the increased value resulting from changes in urban legislation or zoning.

For landowners and developers, this new legislation, known as Interlinked Operations, meant that they did not have to wait for changes in the zoning laws that occurred only once in a year and sometimes were very complex and quite “expensive” (often they had to bribe legislators to approve specific changes for specific properties). Owners and developers learned to share these value increases with the public sector and were convinced that the arrangement was favorable to them. They agreed to pay for the additional construction rights they needed for their projects because it was faster and less expensive than it would have been if they had to buy additional land, which was not always available.

Another positive side effect of this practice was that public servants gained expertise in valuing land and negotiating the increment value with the private sector. Although in terms of planning, this practice did not contribute to the city’s urban development, it provided extra financial resources to help solve part of the problem of slums located in risky areas, and thus contributed (on a very modest scale) to financial and social sustainability.

The New Constitution and Urban Development

In 1988 when Interlinked Operations began to be used in São Paulo, a new Constitution was approved in Brazil. Articles 182 and 183 concerning urban development established, among other things, the principle of the social function of land ownership and enshrined the separation of the right of property from the right to construct. But the regulatory acts necessary for these two articles to become operational were approved only in 2001. In that year the regulatory law (Law 10.257, Estatuto da Cidade, or City Bill) was approved and only then did the new instrument begin to have practical effects in all Brazilian cities.

Nevertheless, many cities and states did not wait 13 years to approve the local regulatory acts necessary to use these two constitutional articles in their jurisdictions. They included these constitutional principles in their specific constitutions, approving the complementary legislation necessary to make them valid and operational.

The city of São Paulo was a pioneer in this matter and in 1990 adapted its Municipal Constitution (Lei Organica do Municipio) to the Federal Constitution, regulated Urban Operations, and sent both of them to the City Council for approval.

What is a Joint Urban Operation?

A joint urban operation, usually known as an urban operation (UO), can be understood as a structural transformation instrument for a part of the city, promoted through a partnership between public authorities and private developers. It involves the participation of landowners, investors, residents, and other stakeholders and has to be approved by the City Council.

For this partnership to take effect, UOs entail certain elements. The most important are urban incentives tied to contribution payments that attract private investment and induce developments to provide the transformations desired in urban policy. These incentives, originally defined by the specific laws of each urban operation, are now established in a general form by the Estatuto da Cidade. The incentives are changes in land characteristics (FAR, for instance), flexibility in land use and occupation requirements, and changes in building norms.

In certain cases, the city may issue and sell Cepacs (Certificates for Additional Construction Potential) in auctions to developers, which corresponds to additional rights to build. ( This instrument will be explained in more detail latter) .

The UOs affect certain areas of the city and are intended to promote urban interventions according to specific objectives defined in the Master Plan and in municipal urban policy. These interventions presuppose mid- and long-term management measures such as a new urban plan for the area , land readjustement mainly in areas occupied by slums, improvements to public spaces, the definition of real estate potential, and land use requirements. (for a detailed description, see Montandon and De Sousa, 2007).

In the city of São Paulo, UOs were mentioned in early Master Plans, but as a planning instrument they were incorporated only in the 2002 Master Plan. During the 1990s, the city administration sent individual proposals for Urban Operations to the Council. In other words, Urban Operations were used before 2002, but did not form an interlinked group of planning interventions for the city as a whole.

The Practice of Urban Operations

In practical terms, an urban operation is an intervention in a large area of the city that requires infrastructure and urban improvements such as avenues, drainage, housing for low-income families, public facilities, and other investments. The funds necessary to allow these investments should come from the incremental value realized by changes in zoning to permit increases in FAR and changes of use. Owners of properties inside the perimeter of the Urban Operation may propose projects that require changes in FAR, permitted uses, or building footprints.

The administration examines the project and analyzes whether it is satisfactory from an architectural and urban point of view. If the project is approved, the next step is to estimate the value increment and determine how to share this value between the owner or developer and the public sector.[1] Each Urban Operation has specific instruments to determine the public-sector participation in the value created by the new zoning coefficients. In some UOs, participation is determined by a minimum percentage of the increment value created; in others, it is realized by selling Cepacs, as we will see later.

From 1990 on, 13 Urban Operations were proposed, but only five were approved before 2008: three during the 1990s and two in 2004. These operations were the Anhangabaú-Centro UO, the Água Branca UO, the Faria Lima UO, the Àgua Espraiada UO, and the Rio Verde-Jacu UO, which was included in the São Paulo Master Plan of 2002 (Law 13.872 of 2004). The total area occupied by these UOs represents about 20 percent of the total area of the municipality. Each one of these operations had particular characteristics and different motivations.

The new Master Plan of 2002 consolidated four UOs created before its approval and created nine more: Diagonal Sul, Diagonal Norte, Carandiru-Vila Maria, Rio Verde-Jacu, Vila Leopoldina, Vila Sônia, Celso Garcia, Santo Amaro, and Tiquatira. But before April 2008, only the Rio Verde-Jacu UO was approved by City Council.

Urban Operations in Sao Paulo since 1991

The Anhangabaú-Centro Urban Operation (Law 12.349/97)

Initially this UO affected an area of about 450 hectares. Later the area was enlarged to 582 hectares and the projects was renamed Urban Operation Centro, because it was located in the center of the city.

The main objectives were the renewal of the historical center of the city, the completion of some investments in infrastructure, the restoration of public spaces and buildings with historical and cultural interest, the doubling of the area covered by drainage system, and the regularization of the building occupied by the São Paulo Stock Exchange Market which had been enlarged beyond the area determined in the project, and paid an economic compensation for this difference to be authorized to operate.

A few private projects were presented, most requiring regularization and/or change in uses and to a lesser degree an increase in FAR. The economic compensation of these operations was not very significant − about 12 million dollars (until 2007).

This UO did not produce the expected effects of attracting new private investments and population increment. Despite the incentives offered, many private firms and families moved out of the central area to other regions. Only departments of the state and municipality governments (and the City Hall itself) moved there and mitigated the outflow of investments and people from the Central area. Nevertheless, the consequence was a population decrease, income reduction, and a considerable number of empty buildings. But it is reasonable to point out that these negative tendencies could be much more intense if the incentives of the UO were not present.

The most deteriorated area inside the perimeter of this UO of the old center of São Paulo covered approximately 23 blocks known as “Cracolandia,” where narcotics, crack, and other drugs were traded freely. The great majority of buildings were irregular, because they were constructed, maintained or operated not according to the building regulations and/or zoning norms. Many commercial activities closed when the administration began to prepare the area for new investments after September 2005, when the city declared the area of public interest and created the possibility of urban and architectural revitalization. In October 2007 the administration began the expropriations of buildings and houses within these 23 blocks, but the revitalization process is very slow and up to May 2009 any significant change had occurred in that perimeter.

As this area was inside the perimeter of the Anhangabaú-Centro Urban Operation, the project could have used the mechanisms permitted by the UO to succeed. But the administration wanted to use a new instrument to finance the entire project: the Fundo de Investimento Imobiliário (FII), inspired by the REIT (Real Estate Investment Fund) used in the United States. The idea is to obtain and prepare land through expropriation, determine higher urban coefficients (FAR and others), and sell bonds to interested firms to attract new activities and spur the construction of new buildings in the renewed area.

This revitalization project is one of the largest in the city in the last decades but problems over expropriations and private partnerships have delayed the conclusion of the project and consequently the beginning of concrete interventions in the area.

The Àgua Branca Urban Operation (Law n. 11.774/95)

This UO covers about 500 hectares and is located in a relatively downgraded area – the Barra Funda neighborhood. This area was formerly occupied by traditional industries, but is now home to commercial enterprises, service industries, and middle-class housing. As an industrial area, the land had a very low FAR (ranging from 0.5 to 1.0). The new activities required significant increases in FAR and, in some cases, changes in use.

Before 2005, only a few private projects were proposed, although one of them was a large one requiring more than 200,000 m2 of additional construction area and an increase of FAR from 1 to 4. In this UO, the minimum compensation for the public sector from benefits granted to the developer was 60 percent of the increased value, which would have resulted in about 20 million dollars compensation to be used in infrastructure improvements and construction of social housing.[1] This proposal was to build 13 large commercial and service industry buildings. But during the economic recession from 1999 to 2003, the entrepreneur suffered losses and could not continue the project. He finished only four of the 13 buildings scheduled. The compensation from the project ceased as well, and the entrepreneur delivered only 20 percent of the $20 million the city had expected.

After 2005, with the beginning of a new expansion cycle of real estate business, more than 15 new projects were proposed. Those already approved have so far yielded more than 13 million dollars in capture value to be used for infrastructure and social housing. Other projects for residential buildings that are currently being examined by the administration may yield up to 130 million dollars.

Among these new projects is a large one that is worth mentioning because it represents a break from the traditional developer’s attitude towards the construction of houses for low-income families.

The Água Branca UO contains an area defined as a ZEIS (one of the Zonas Especiais de Interesse Social or Special Zones of Social Interest).[2] The ZEIS areas can be occupied only by social housing, or a specific percentage of the housing must be destined for low-income families. The main reason for establishing these zones is to avoid or minimize gentrification, and prevent the displacement of low-income families from areas where the price of land is rising as a result of public investments and the demand for land has shifted from low-income households to medium- or higher-income buyers.

One of the projects proposed was a large one in a ZEIS area. On a large plot of 63,000 m2, the developer intended to build 27 buildings containing 2,714 apartments ranging from 45 m2 to 100m2. This means that developers had found a way to profit from constructing houses for low-income families.

The Faria Lima Urban Operation (Law n. 11.732/95)

With an area of 450 hectares, this UO is a quite different from the Centro or Água Branca UOs. While those UOs were located in derelict areas with considerable unused infrastructure capacity and a possibility for higher densities, this area was already dynamic, with rising land prices, intense real-estate development, and pressure to extend a road called Faria Lima Avenue. Although the existing densities were not high, developers demanded the maximum allowed in the legislation (FAR 4); this change could only be obtained properly by the approval of a UO.

Therefore, the motivation for this UO was to increase FAR and permit changes in uses in the area affected by the construction of the avenue (which had no priority from a transportation point of view) to allow developers to construct high-quality residential, commercial, and service buildings.

The decision to extend the avenue was taken before the UO proposal was presented to City Council and despite the protests of people who would be affected by expropriations. The easiest way to obtain an increase in FAR and the change in uses was to approve the UO. The alternative (in the absence of a UO) was to construct the avenue and then change the zoning in the UO area. This would be a much more complicated process demanding more negotiation between developers and City Council and the inclusion in the new zoning of individual properties. The public sector wanted a quick solution that would include all the area affected by the enlargement of the avenue. So the administration approved the UO, even though it meant that developers and owners had to share the value increased caused by the zoning changes.

The avenue extension began in 1994 and the UO was approved in 1995. The cost of expropriations and the construction of the avenue are difficult to estimate, because the administrations between 1993 and 2001 were not distinguished by transparency, but the investment was probably about 150 million dollars. This is a significant amount of money, and the expenditure was financed by the municipal budget, causing a deficit and consequently a public debt with an average interest rate of more than 15 percent a year.

By March 2009, the Faria Lima UO had produced about 400 million dollars in economic compensations and only now 13 years later we can say that the pay back of the initial investment of 150 million dollars (interests considered) has been completed.

Moreover, this UO contains more than 800 thousand m2 to be sold over the next five or so years, so a considerable “profit” will be realized. The problem is that this “profit” cannot be used to pay down the debt incurred and inflated by the interest paid during these years by the expropriations and the construction of the avenue. The income obtained can only be used in new interventions inside the perimeter of the UO. It may even be that the income obtained in the future by selling Cepacs will be more than is the amount needed for work inside the perimeter of this UO. If that happens, how will the extra income be used?[3]

It is important to point out that Faria Lima and Água Espraiada UOs, by the removal of slums[4] and the displacement of low- and middle-class families by high-income families provoked the highest level of gentrification among UOs. This topic will be discussed further below.

The Àgua Espraiada Urban Operation (Law 13.260/2001)

The Água Espraiada UO occupies about 1,425 hectares and was approved in 2001 after Água Espraiada Avenue had been constructed. The construction of the avenue required the demolition of slums (Fix, 2001) and was associated with a process of gentrification.

In the Água Espraiada UO, as in Faria Lima, the construction of the avenue and the necessary expropriations demanded a huge amount of money. This money was obtained through increasing public debt, although the figures for principal and interest paid are not available. Nevertheless, as the avenue was built many years before the onerous grant mechanism began to operate, it is likely that (as with Faria Lima Avenue) a considerable amount of money was dedicated to pay interest on the debt produced by the initial investment.

This UO was approved after the introduction of the Estatuto da Cidade, so it could use the Cepacs mechanism to capture value from the onerous grant.[5]

The avenue is not yet finished and its extension required funding for a bridge over the Pinheiros River (already completed with funds from Cepac auctions) and for a link to a road (Imigrantes) that connects São Paulo and the Port of Santos. At least eight slums must be removed and it will be necessary to construct social housing for the affected families inside the perimeter of the UO, in addition to the high cost of constructing the avenue itself.

The Água Espraiada UO has 4.85 million m2 of additional area to be sold through auctions of 3.75 million Cepacs (each Cepac may represent more than 1 m2). As of November 2008, 1,180,000 Cepacs (or nearly 24 percent of the total stock) had been sold, with an income of 320 million dollars. The extension of the avenue will demand the removal of many slums located in the edge of the Água Espraiada creek and the construction of new houses for these families inside the perimeter of the UO. The funds to finance the construction of these houses and finish the construction of the avenue are already in hands of the City Hall. It is interesting to say that the money obtained in the first Cepacs auctions in 2004 was to be used for the construction of 600 units of social housing for families from the Jardim Edith slum[6] and an estayed bridge over the Pinheiros River. The bridge was constructed, but only now ( June 2009) the social housing are beginning to be built.

The Rio Verde-Jacu Urban Operation (Law 13.872/04)

This UO covers nearly 7,400 hectares, making it the largest one studied here. It is located in the periphery of the city and one of its poorest areas, so the construction of the necessary infrastructure could not be financed with funds collected through the sale of additional potential construction rights, because developers were not interested in investing there immediately.

The main objective was to attract industrial, commercial, and services activities through incentives such as the reduction or temporarily elimination of taxes. The creation of employment is also an important objective. This UO is also intended to improve transportation and connections with the rest of the city while creating public and green areas for leisure and environmental preservation and protection. The UO established an additional potential construction area of 3,570,000 m2.

This UO introduced an element of public participation, as its Executive Committee was composed not only of City Hall experts and administrators, but also included representatives of local businesses, workers, and people living inside the perimeter. However, since its creation in 2004, this Committee has met only once. As of 2008, very little had been done to implement its possibilities.

Another problem with this UO is that it includes many environmental protection areas, and for some projects it takes too long to secure the necessary permits. Moreover, the high costs for the necessary Environmental Impact Studies and the low returns expected by private developers offer little incentive for investment, except for projects with high state participation. This UO is not yet fully operating, although the municipal government through other mechanisms has attracted investments of about 20 million dollars of private firms with the creation of around 1.000 jobs.

Impact of Urban Operations

Even a superficial look at the Urban Operations created before the 2002 São Paulo Master Plan indicates that they do not constitute steps in a clearly articulated plan. They were introduced to solve particular problems, not linked with other regions of the city or not answering questions arising from the analysis of the city as a whole. But at least they created mechanisms to capture value and contributed to a sustainable process of financing infrastructure and social housing. Even if the construction of avenues in the Faria Lima and Água Espraiada UOs meant the expulsion of poor communities living in slums and facilitated gentrification, the instrument represented by the UO helped to mitigate these processes.

It is important to note that the process of gentrification had already begun before the approval of the Faria Lima and Água Espraiada UOs, and were intensified with the construction of the two avenues in these areas. The creation of ZEISs inside the Água Branca, Água Espraiada, and Faria Lima UOs helped mitigate the problem of slums and blocked (at least until 2008) the expulsion of the remaining slums, especially in Água Espraiada and Faria Lima (including the Coliseu and Jardim Edith slums). And, although developers’ lobbies are exerting pressure to eliminate them, the UO and the Master Plan have determined that these slums must be urbanized where they are, or if families are removed, they have to remain inside the perimeter of each UO (and not expelled to the periphery), thereby mitigating the gentrification process.

But there are many menaces against ZEISs. During the revision of the Master Plan of 2002 in 2007 (every five years the Plan may be revised) there was a frustrated intent to eliminate ZEISs from the Água Espraiada UO. Currently additional UOs have been proposed and it is probable that the offensive against ZEISs will be relaunched.

UOs were the only instrument the administration had at its disposal to direct or control (or to try to control) urban development until the approval of the São Paulo Master Plan of 2002. Nevertheless, practices and instruments created and used in the UOs and in many cases their contradictory results can show the narrow limits they provide in attempting to plan the development of the city in a balanced and sustainable way.

We will now examine the Cepacs as a tool for capturing value from the onerous grant mechanism, or as a instrument to support the financial sustainability of urban development.

Cepacs: A New Instrument of Value Capture

The Faria Lima and Água Espraiada UOs included a new instrument, the Cepac, which means certificate (bond) for potential additional rights of construction. This instrument could be used by the city to capture value or receive economic compensation from projects proposed by developers. It was created and included in the Faria Lima UO in 1995, but only began to operate fully in 2004, after the approval of Estatuto da Cidade in 2001, when Cepacs could be used in all Brazilian cities.

The Cepacs are issued by the City Hall through EMURB (Empresa Municipal de Urbanização) and sold in electronic auctions in São Paulo stock market (Bovespa) and may only be used inside the perimeter of the UO in which they were issued. They give the bearer additional building rights as larger floor area ratio and footprints and change uses in his plot.Financially speaking the result of selling Cepacs means the economic compensation a developer gives the public administration for the new building rights received.

In São Paulo, only two (Faria Lima and Água Espraiada) of the five UO approved, can use Cepacs. The others don’t use it because when they were approved they did not include Cepacs as a tool to capture increment value.

The total amount of Cepacs that can be issued depends on the total additional area each UO is able to support. This number depends on the previous analysis of the group of architects, engineers, economists and public servants that compare this upper limit with the existent infrastructure and all the additional works that will be financed with funds originated by selling Cepacs.

In each UO Cepacs have the same face value but correspond to a different amount of m2 depending on the location (inside the perimeter) of the plot where they are going to be used. For instance, in Faria Lima UO the initial price of Cepacs (determined by Faria Lima UO Law) is about 550 dollars but may correspond to a minimum of .8 m2 to a maximum of 2.8 m2 depending on the sector in which these Cepacs are going to be used. This difference is due to the different prices of plots depending on the sector inside the perimeter where they are located. If a developer uses his Cepacs in very expensive plots each Cepac will correspond to .8 m2; if the use is in very cheap areas each Cepac will enable him to construct additional 2.8 m2. The final price of Cepacs in auctions may be higher than this initial value all depending on the interest of the buyers. Between Dec. 2004 and March 2009 this price rose from 550 dollars to 850 dollars. In Agua Espraiada the initial value of Cepacs was 150 dollars and the correspondence in m2 ranged from 1.0 to 3.0 m2. Between July 2004 and Oct. 2008 prices rose from 150 dollars to 270 dollars.

One of the main advantages to the city of this form of value capture is to obtain compensation before the developer begins the construction of a project, so the public sector may finance the construction of infrastructure without incurring a deficit or public debt or using budget resources that could be employed in other activities, such as education or health.

For the developer, to buy Cepacs is to buy a right to construct. These rights may be used whenever the real estate business cycle recommends doing so, or when the entrepreneur decides is the best moment to launch a project.

The City Hall may also use Cepacs, through private auctions, to pay contractors (if they accept) who have contracts to build infrastructure. In these private auctions there are no bids as in public auctions. The City Hall sends letters to creditors offering to pay the debts with Cepacs at a determined value, generally the price of the last auction. In Faria Lima UO between Dec. 2004 and Oct. 2008 these private auctions produced an income of about 80 million dollars.

In other words, Cepacs may be used directly as a non-budgetary fund to pay for goods and services which are necessary to install or renew infrastructure or construct social housing.

Between July 2004 and March 2009, the income produced by Cepacs in the Faria Lima and Água Espraiada UOs was, respectively, 260 million dollars and 320 million dollars or a total of 640 million dollars considering all public and private auctions.

The income from each square meter sold by Cepacs yields a bigger revenue for the public sector than was produced using the former mechanism of a percentage ranging from 50% to 60% of the increment value. A sample of 12 important projects in Faria Lima UO shows that if Cepacs had been used, the income would have risen from 31 million dollars to 140 million dollars. Moreover, in the auctions held to date, prices have risen around 25 percent over inflation in the Faria Lima UO, and in average more than 50 percent in the Água Espraiada UO.

Price Increase of Land in Urban Operations.

To exercise the additional construction rights provided by Cepacs it is necessary to have land in the physical sense of the word. In other words, the use of Cepacs depend on the ownership of land inside the perimeter of an UO. So the demand for land rises, along with prices. This is especially true of the Faria Lima UO. We have no consistent data to demonstrate this effect for all UOs, but indirectly we may estimate the rise in prices in the Faria Lima UO.

Some important differences can be noted by comparing the situation before 1996 with the later period, when the Faria Lima UO projects had begun. The average price per square meter of constructed area in the perimeter increased from R$1.681 in the 1991-96 period, to R$1.916 in the 1996-2001 period, a 14 percent increase, while during the contraction of the business cycle in the metropolitan region of São Paulo (RMSP) in the same period, prices decreased from R$1.211 to R$1.064, or by 12 percent. Therefore the relative increase in prices per square meter in the Faria Lima UO relative to that of the São Paulo region, was around 26 percent. This considerable price increment contributed to the gentrification process. But this increase reflected not only the rise in land prices, but also the high quality of construction.

Real Estate Concentration and Tax Collection

To estimate the impact of UOs on land concentration and the increase in income from property taxes, we will also use data from the Faria Lima UO, where a considerable land concentration can be observed.

This concentration was due, on one hand, to the fact that since the 1950s the region has been occupied by single-family houses on small and medium-sized plots (between 200 and 400 m2) and, on the other, to the fact that new commercial and, to a lesser extent, residential buildings need greater areas for new architectural projects, especially those incorporating luxury elements.

For instance, 115 selected projects approved between 1996 and 2003 required the use of 657 plots, for an average of 5.7 plots per project. Approximately 65 projects involved the construction of residential buildings and the remaining 50 were business buildings.

The changes caused by the replacement of single-family constructions by upper-middle-class residential and commercial buildings resulted in a substantial increase in he income of IPTU (the urban property tax or tax charged over land and buildings in urban areas) in the region. Many blocks previously occupied by single and two-story homes constructed in the 1950s and lasting for 25 to 30 years, enjoyed a tax (IPTU) discount for buildings obsolescence of up to 30 percent. They were replaced with new buildings of several floors and of a high construction standard for which the discount was zero. A higher tax is levied on higher quality buildings, and our estimates indicate that the tax per square meter constructed may have been between 2.7 times and 4.4 times the former tax.

As the number of square meters constructed increased in the region, the total amount of IPTU collected must have risen considerably. Therefore the mechanism of value capture (in this case made viable by the UO) also helped increase the amount of tax collected for the city. Nevertheless, this is also a manifestation of the gentrification process, because not only did the prices of land and construction rise, but also the property taxes. These increases restricted the access of lower-middle-class families to the region.

Impact on Construction Density, Population, and Gentrification

During the 1990s, some indicators show that the population was abandoning the Faria Lima OU area. The same phenomenon was happening in other traditional and central areas of the city. This process of population decrease had already been observed before the approval of the UOs, but it intensified after 1996.

In the case of Faria Lima, building density increased: a simple examination of aerial photographs between 1994 and 2001 shows this clearly. This apparent contradiction – less population, more buildings − is explained by the considerable presence of commercial and service buildings, which replaced the homes of lower-middle-class families. This finding is confirmed by the census data, since residential densities fell considerably between 1991 and 2000, from 27 to 22 persons per hectare.

The combined increase in building height for residential and business buildings and in income, with the reduction in household density, is another signal of the gentrification process in the Faria Lima OU area during the 1990s.

This gentrification process intensified when the extension of Avenue Faria Lima (and the construction of Avenue Água Espraiada) began in the mid of 1990 with the demolition of slums and displacement of middle-class residents through expropriation of the necessary areas for the construction of the avenue. This was the first stage of the gentrification process.

The second wave occurred when developers who needed large areas to construct high-quality buildings offered large sums to lower-middle-class owners of small plots or the owners of small business units. In this sense the replacement of lower-middle-class families and small business units by high-income groups and large international firms resulted also in a concentration of land ownership.[7]

Yet even if these lower-middle-class families suffered pressure to leave the area and social problems created by displacement, they were at least financially compensated, because the price of land rose considerably. The same did not happen with families living in slums: they were simply expelled with a very small amounts of compensation.[8]

A New Master Plan

A new Master Plan for São Paulo was approved in 2002. Between 1987 (when the first legislation for value capture was created) and 2002, the main instruments of urban intervention were the Urban Operations, since Interlinked Operations were forbidden in 1998. But this new Master Plan created at least three instruments to promote sustainability, one related to financial sustainability, one to social sustainability, and the third to environmental sustainability. The new Master Plan also consolidated the existing UOs and created nine more.

New Urban Operations and the General Reduction of Floor Area Ratio

The Master Plan of São Paulo approved in 2002 incorporated and adapted all the instruments permitted by the Estatuto da Cidade approved in 2001. The four UOs operating were consolidated and improved (with the creation of ZEISs inside their perimeters) and nine more were created.[9]

Among other instruments connected to the increment value mechanism (solo criado) concept, the new Master Plan reduced the average FAR for all urban land not included in UOs. Now there is a basic FAR and in the largest part of São Paulo area it is equivalent to 1 (one), but in some more distant areas this basic FAR can be a maximum of 2 (two). Owners/developers who now intend to construct above this basic level (with exceptions for social houses, hospitals and other activities with public and social interest) to a maximum of 2,5 have to pay for the value increment produced by the difference between the basic and the maximum FAR permitted . It is interesting to say that many landowners whose land had formerly FARs of 2, 3, or 4 with the new Master Plan lost part of these rights and now if they want to construct more area they have to pay for it. [10]

The value capture in areas not within UOs began slowly after 2002, because developers, anticipating the approval of the new regulations, had obtained their construction licenses according to the former (and cheaper) conditions. During the next three or four years, they had licenses in accordance with the former zoning legislation and had to pay nothing to the administration if their lots exceeded 1 or 2 FAR.

But with the beginning of a new real estate market boom in 2005, a number of new licenses following the new rules were demanded and approved. According to the Master Plan, there was a stock maximum of 6.9 million m2 of residential area to be used, of which 1.3 million m2 (18.8 percent) was contracted up to February 2008, according to this new method. As for non-residential activities, the stock was 2.8 million m2 and 0.155 million m2 (5.5 percent) was contracted up to the same date.[11]

This means that the entire São Paulo municipality area now may be subject to increasing land building potential and the conversion of the benefits in onerous grants. Depending on how much developers want to build (to a maximum FAR of 2.5), a bigger or smaller share of this increment value may be appropriated by the public sector. These conditions are important to the financial sustainability of the city, because formerly the pressure exerted by growth on infrastructure was all financed by public funds. With these new procedures, part of the value created by city growth is used to finance the expansion of the infrastructure this growth has demanded.

ZEISs and Social Sustainability

The new Master Plan created 750 ZEISs scattered around the urban area, representing a total of 32 km2. These areas are intended to provide land for the construction of social housing. The majority of these zones are already occupied by slums and are in peripheral areas of the city. But in some cases, these slums are in expensive areas near or even inside the most dynamic districts of the city.

By creating ZEISs, the land has lost its economic highest and best use, and where slums exists, they will likely be urbanized. This may be the most powerful instrument to avoid or to mitigate the gentrification process, although most of these ZEIS areas are already in the periphery of the city.

ZEPAMs: The Right of Preference and Environmental Sustainability

The new Master Plan also created 22 zones where there is the right of preemption or preference. This means that the government has the option to buy the land from the private landowners to build public parks and large reservoirs to mitigate floods.

Environmental protection is supposed to be ensured by the creation of ZEPAMs (zones of environmental protection), mainly in the south where the great city reservoirs and the sources of rivers are located, and in the north, where there are still some native forests and some water sources.

Although the Master Plan created this instrument of environmental protection, there is no guarantee that these areas will be respected. Invasions of poor, middle-class, and rich families are very common, for various reasons. And there is no punishment for those who flout the Master Plan. In other words, it is necessary but not sufficient to create official mechanisms of environmental protection. The forces that are impelling urban development are strong and chaotic and conspire against environmental sustainability. Other instruments are needed to tame these forces on behalf of a balanced urban development.

The Problem of Transportation

Since the beginning of the 20th century, the intense growth of the city in area and population caused problems for public transportation. From 1900 until the 1930s, the main form of public transportation was tramways (streetcars) that used electric energy, although some motor buses came into use in the 1920s, along with private cars.

But in the 1940s, the Light and Power Co. responsible for streetcars was not interested in expanding its lines following the growth of the city because of the low level of the tariffs, which were controlled by the government. These tariffs did not pay for the considerable investment necessary to extend the rails and the electric cables. So public transportation by motor buses began to increase, first in the newer neighborhoods (where the Light & Power Co. was absent) and within a few years, buses replaced streetcars throughout the city.

Only in 1970 was the first line of rail-based transit built. But this decade was the decade of cars. Traffic congestion increased and the speed of buses diminished, making the transportation service even worse, particularly transportation to the most distant communities.

At the end of the 1980s and beginning of the 1990s, public transportation by buses was provided 30 percent by the public sector and 70 percent by the private sector. Both services were poor, although communities in periphery of the city were attended mainly by transportation provided directly by the public sector. Public transportation in São Paulo faced an important crisis in the 1990s, when the service was completely privatized. Since then, many efforts have been made to improve the service, with the construction of exclusive corridors and the extension of the subways, but public transportation remains one of the most important city bottlenecks.

In São Paulo, as in other large cities, there is a contradiction between public transportation and people who need it most: the high price of land in the central area forces poor families to the periphery, where they have to pay more for transportation to the city’s central zone to get to jobs and other opportunities to make a living. So the highest fares are paid by those who have the lowest income and cannot afford an alternative. If the government sets low and affordable tariffs, private transportation entrepreneurs cannot make a profit and the service will be bad or non-existent.

The consequence of this contradiction is that public transportation in cities like São Paulo must be subsidized if social sustainability is to be preserved. The public administration must directly assume the function or contract with the private sector for the service (allowing for a reasonable profit without raising fares). This arrangement should guarantee the normal function of the transportation system.

But in doing so, the city must divert financial resources that could be destined to other activities as education and health or investment in other forms of infrastructure. To mitigate this problem the Master Plan aimed to create new employment centers in the periphery, such as the Verde-Jacu UO. The intent is to reduce the need to commute (and its cost), while revitalizing and increasing densities in central areas (particularly the Anhangabaú-Centro and Água Branca UOs), and avoiding the process of expelling poor families to the periphery.

Conclusions

The urban development of São Paulo was intense during the 20th century, but it was not planned for sustainability, even if after 1960 Master Plans were approved and adopted by the municipal administration. Development was unbalanced, causing exclusion and a shortage of public services among the poor, who lived mainly in peripheral zones. The economic crisis of 1980 to 1990 reduced the capacity of public investments and maintenance and worsened the situation for these groups.

At the same time, democratization and a new Constitution brought new instruments of intervention and an increase in social participation in important political decisions concerning urban development. These new instruments allowed the public sector to recover legal and financial power to intervene and increase the capacity of planning in the urban areas. São Paulo city was a pioneer in approving and using these instruments and constituted a benchmark for urban development in Brazil.

With the 2005 recovery from the economic crisis, the legal instruments created by the Estatuto da Cidade in 2001 (regulation of articles 182 and 183 of 1988 Constitution) and the new Master Plan of 2002, the city was in a better position to face the chaotic tendencies of urban development.

From the perspective of sustainable development, it is reasonable to say that Urban Operations contributed to contradictory results. From a financial perspective, they helped the administration to capture value which in other circumstances would have be captured by owners or developers and to use this money to build infrastructure and social housing without using budget resources. But they accelerated the rise in land prices and so increased the pressure on poor families in slums and on lower-middle-class families in other areas to move. The introduction of the ZEIS helped to mitigate these tendencies, but even this instrument has had only limited results because up to now only in the Água Branca UO has a slum been partly urbanized. In the Faria Lima and Água Espraiada UOs, the slums have not yet been urbanized and there is pressure to suspend the ZEIS areas.

The first two UOs (Água Branca and Anhangabaú-Centro) did not demand previous investments from the public sector and the works in infrastructure are being made with the economic compensations provided by the private projects approved until now. In other words the pressure on budget was eliminated.

The last two (Faria Lima and Água Espraiada), by comparison, demanded considerable public investment for expropriations and the construction of avenues before economic compensations were received, increasing public indebtedness and precluding financial sustainability.

The extension of Faria Lima Avenue and Água Espraiada Avenue to a lesser degree resulted in gentrification, with the expulsion of poor families living in slums and lower-middle-class families, who were replaced by the upper-middle-class households. Small shops are being replaced by malls, shopping centers, and the modern and expensive offices of multinational corporations. The UOs created in these two areas with mechanisms of value capture and ZEISs as an instrument to mitigate the displacement of low-income households are still operating and the results are not yet clear.

The Água Espraiada UO has many slums located in areas that will be needed for the extension of the avenue. Other are located in ZEISs and are to be urbanized. Cepacs already sold and the available stock will provide the funds for these investments, but the offensive against ZEISs may continue.

The growth of the city in area and population and the absence of efficient forms of mass transportation such as subways, trains, and bus corridors have resulted in an extraordinary growth of individual transportation by automobiles (from lower-middle-class households to more affluent families) and a great expansion of commuting by foot by the poorer segments of the population. This process has caused traffic congestion and air pollution and increasing costs in services such as sewage disposal, garbage collection, security, and lighting, and does not contribute to a sustainable environment from an ecological and social perspective.

At least three out of four of São Paulo’s UOs (Água Branca, Faria Lima, and Água Espraiada) included the construction of large avenues and created new areas for cars and buses. As public transportation services did not improve, the opening of these avenues, even if they at first relieved congestion somewhat, stimulated the increased use of automobiles. In a very short time, these new avenues were as congested as the others, as cars and buses competed for space, preventing higher speeds in public transportation services.

Before 1987 all changes in zoning and increment value due to public investments were generally captured by the owner of the land and/or developer of real estate projects. After 1987 the new legislation allowing Interlinked Operations, Urban Operations, and the reduction of FAR, separating the property right and the right of construction, together with the determination of the social function of land, brought new procedures and a form of participation by the public sector in all value created by urban development. But the way these instruments have been used by São Paulo’s administrations since 1988 (with some exceptions) did not necessarily result in the mitigation of unsustainable situations produced by market-oriented urban development.

However the effects of Urban Operations and the 2002 Master Plan over the dimensions of sustainability in the economy, equity and ecology are currently being developed and there are promising results from ZEISs, Cepacs, and the reduction of FAR in all areas not belonging to UOs, but the results of creating special zones of environmental protection (ZEPAMs) are not yet available.

Bibliography

Azevedo N, Domingos T de (1994) O jogo das interligadas. Uma política pública em avaliação: a Lei 10.109/86 do Município de São Paulo. Dissertação de mestrado em Administração Pública apresentada à FGV/Escola de Administração de Empresas de São Paulo

Altshuler, A, Luberoff, D (2003) Mega projects: The changing politics of urban public investment. Brookings Institution Press and Lincoln Institute of Land Policy. Washington D.C. & Cambridge, Mass.

Beznos, C (2002) Desapropriação em Nome de Política Urbana. In: Dallari, A, Ferraz, S (eds) Estatuto da Cidade: Comentarios a Lei Federal 10.257 de 2001). Malheiros Editores, São Paulo

Carmona, M, Shoonraad, M (eds) (2002) Globalization, Urban Form & Governance. Faculty of Architecture, Department of Urban Renewal and Management, TU Delft, Nederlands

Castro, S Rabello de (2003) Justa indenização nas expropriações urbanas: Justiça social e o enriquecimento sem causa: Anatomia de um conceito. Mimeo.

Chapman, JI (1998) Tax Increment Financing as a tool of Redevelopment. In: Ladd, HF (ed) Local Government Tax and Land Policies in the United Satates: understanding the links.Lincoln Institute of Land Policy, Washington.

Clichevesky, N (2001) La Captación de Plusvalias Urbanas en la Argentina. In: Smolka, M, Furtado, F (eds) Recuperación de Plusvalias en América Latina, Eurelibros, Santiago de Chile

De Ambrosis, C (1999) Recuperação da valorização imobiliária decorrente da urbanização.” In: O município no século XXI: cenários e perspectivas. Fundação Prefeito Faria Lima, CEPAM, São Paulo

Feldman, S (1996) Planejamento e zoneamento. São Paulo, 1947-1972. Doctoral thesis, Faculdade de Arquitetura e Urbanismo da Universidade de São Paulo, São Paulo.

Fernandes, E (2001) Direito urbanístico e política urbana no Brasil. Del Rey, Belo Horizonte

Fix, M (2001) Parceiros da exclusão. Boitempo, São Paulo

Fundação Prefeito Faria Lima (CEPAM) (1997) O Solo Criado/Carta de Embu. São Paulo.

Furtado, F (1997) Instrumentos para a Recuperação de Mais-Valias na América Latina: debilidade na implementação, ambigüidade na interpretação. In: Cadernos IPPUR 11, (1 & 2): 163-206. IPPUR, Rio de Janeiro

Grazia, G de (2001) Reforma Urbana e o Estatuto da Cidade. In: Gestão Urbana e de Cidades. Fundação João Pinheiro/Lincoln Institute of Land Policy, Belo Horizonte (CD-ROM)

IPEA (Instituto de Pesquisa Econômica Aplicada) (1998). Gestão do uso do solo e a disfunções do crescimento urbano. Avaliação e Recomendações para a Ação Pública, Brasília

Jacobs, J (1961) The death and life of great American cities. Random House, New York

Jaramillo, S (2007) La experiencia colombiana en la recuperación estatal de los incrementos del precio del suelo: La contribución de valorización y la participación en plusvalías. In: Smolka, M, Furtado, F (eds) Perspectivas Urbanas : Temas críticos em Políticas de suelo em América Latina. Lincoln Institute of Land Policy. Cambridge, Mass.

Lima, A, Campos, LA (2000) Vazios urbanos e dinâmica espacial: indicadores de sustentabilidade e instrumentos urbanísticos. In: Gestão da terra urbana e habitação de interesse social. FAU-PUC Campinas – Laboratório do Habitat/Instituto Polis/Lincoln Institute of Land Policy (CD-ROM). Lincoln Institute of Land Policy. Cambridge, Mass.

Lungo, M (2004) Grandes proyectos urbanos. In: Grandes proyectos urbanos. Lincoln Institute of Land Policy y UCA Editores. Cambridge, Mass, San Salvador, El Salvador.

Maldonado C, Maria M, Smolka, M (2003) Using value capture to benefit the poor: The Usme project in Colombia. Land Lines, Vol. 15 number 3 (July) 2003, The Lincoln Institute of Land Policy.

Maricato, E, Moreira, T, et al. (2000) Preço de desapropriação de terras: limites as políticas públicas nas áreas de interesse social. In: Anais do Seminário Internacional – Gestão da terra urbana e habitações de interesse social. Campinas: FAU-PUC Campinas – Laboratório do Habitat/Instituto Polis/ Lincoln Insitute of Land Policy (CD-ROM). Lincoln Institute of Land Policy. Cambridge, Mass.

Marques Neto, F de A (2002) Outorga onerosa do direito de construir. In: Dallari A, Ferraz, S (eds) Estatuto da Cidade: Comentários a Lei Federal 10.257 de 2001). Malheiros Editores, São Paulo

Montandon, DT, De Sousa, FF (2007) Land readjustment and Joint Urban Operations. Romano Guerra Editores, São Paulo

Moreira, ACML (2000) Megaprojetos e Ambiente urbano: análise crítica de relatórios de impacto de vizinhança: 1990 – 1996. In: Anais do Seminário Internacional – Gestão da terra urbana e habitações de interesse social. Campinas: FAU-PUC Campinas – Laboratório do Habitat/Instituto Polis/Lincoln Institute of Land Policy (CD-ROM). Lincoln Institute of Land Policy. Cambridge, Mass.

Neto, D de F (1975) Introdução ao direito ecológico e ao direito urbanístico. Editora Forense, Rio de Janeiro

Portela, E, Mendes, A et al. (2000) Planos diretores urbanos: limites dos instrumentos e desafios para a gestão urbana. Anais do Seminário Internacional – gestão da terra urbana e habitações de interesse social. Campinas: FAU-PUC Campinas – Laboratório do Habitat/Instituto Polis/Lincoln Institute of Land Policy (CD-ROM). Lincoln Institute of Land Policy. Cambridge, Mass.

Rabi, NIA de. (1991) O Plano Diretor e o Artigo 182 da Constituição Federal. In: RAM – Revista de Administração Municipal 38 (200): 41-48. IBAM, Rio de Janeiro

Rolnik, R (1997) A cidade e a lei: Legislação e territórios em São Paulo, 1870-1930. Studio Nobel, São Paulo

Sandroni, P (2000) La Operación Interligada West-Plaza: Un caso de apropiación de renta en la Ciudad de São Paulo. In: Iracheta Cenecorta, AX, Smolka, M (eds) Los Pobres de la Ciudad y la Tierra. El Colegio Mexiquense y Lincoln Institute of Land Policy, Mexico

Sandroni, P (2004) Financiamiento de Grandes Proyectos Urbanos. In: Lungo, M (ed) [PC1] Grandes proyectos urbanos. Lincoln Institute of Land Policy & UCA Editores, El Salvador

São Paulo (Cidade), Secretaria Municipal do Planejamento (2000) Operação Urbana Faria Lima, São Paulo, 2000.

Shorto, R (2004) The Island at the Center of the World: The epic story of Dutch Manhattan and the forgotten colony that shaped America. Ed. Objetiva, Rio de Janeiro. Portuguese translation.

Smolka, MO, Mullahy, L (2007) Perspectivas Urbanas: Temas críticos em Políticas de suelo em América Latina. The Lincoln Institute of Land Policy. Cambridge, Mass.

Smolka, M, Amborski, D (2000) Captura de plusvalias para el desarrollo urbano: Una comparación interamericana. Mimeo .

Szmrecsany, T (2004) Historia Econômica de São Paulo. Ed. Globo, São Paulo.

Toledo, RP de (2003) A Capital da Solidão: Uma historia de São Paulo das origens a 1900. Ed. Objetiva, São Paulo

[1] This slum can be seen on Googlearth at 23 30’ 46.89’’ S and 46 41’ 11.16’’ W at an altitude of 570 m. Half of this slum is already urbanized. But after the approval of the UO, another slum was created inside its perimeter. This new one can be seen at 23 30’ 53.95’’ S and 46 40’ 46.92’’ W at an altitude of 490 m.

[2] The 2002 Master Plan established 750 ZEISs (Zonas Especiais de Interesse Social), and 22 ZEPAMs (Zonas Especiais de Proteção Ambiental, or Special Zones for Environmental Protection) in the municipal area of São Paulo.

[3] One of the conditions of a UO is that all the income appropriated by the public sector must be used inside its perimeter. This restriction should be changed to allow the development of less developed areas of the city. It is reasonable to use a percentage of income, say 20 percent, produced in UOs in affluent areas for infrastructure improvements in low-income areas.

[4] The last remaining slum in an area declared a ZEIS can been seen using Googlearth at 23 35’ 36.11’’ S and 46 41’ 24.66’’ W at an altitude of 390 m.

[5] There is some evidence that between 2004 and 2007 there was a kind of “cannibalism” between the Faria Lima and Água Espraiada UOs. The initial price of Cepacs in the former was R$1,100.00 and in the latter R$300.00 and some areas were very near each other. So the developers preferred to buy Cepacs in Água Espraiada and not in Faria Lima. All the auctions in Água Espraiada were successful, and the first two of Faria Lima were failures: the first one sold only 10 percent of the total offered, and the second 27 percent, but in this case only 10,000 Cepacs were offered.

[6] Until April 2009 this slum could be seen using Googlearth at 23 36’ 48.62’’ S and 46 41’ 39.01’’ W at an altitude of 420m.

[7] A sample of eight projects with land areas ranging from 3,500 m2 to 5,500 m2 showed an average fusion of 17 independent lots per project.

[8]The last slum remaining in the Faria Lima perimeter is Coliseu, with no more than 100 houses. The area occupied by the slum was declared a ZEIS (Special Zone of Social Interest) and it will likely be urbanized. But considering the pressure exerted by developers, it is possible that the present administration (2009–2012) will try to change the law to eliminate the ZEIS status of the area, because it is one of the more valuable areas within the Faria Lima UO perimeter. This slum is interesting, because it is surrounded by very modern and expensive buildings. It can been seen in Googlearth at 23 35´ 36.11” S and 46 41´ 24.66” W at an altitude of 390 m.

[9] The present administration (2009−2012) sent to City Council a project (PL 0671/2007) proposing the creation of three more Urban Operations: Amador Bueno, Terminal de Cargas Logístico Fernão Dias, and Pólo de Desenvolvimento Sul. At the same time, the Carandiru-Vila Maria UO changed its name to Estrutural Norte.

[10] In Urban Operations the maximum FAR is 4.0, except in the Anhangabaú-Centro UO, where it is 6.0.

[11] In 2008 the total income by this concept was around 60 million dollars.